College can be one of the most exciting experiences of a student’s life.

Your son or daughter will venture into the unknown, make new friends, take classes taught by experts in their fields, and, most importantly, they’ll probably decide what they want to do for the rest of their life!

While college is a blast, it’s also very stressful in many ways…and when it comes to money, I’m sure you’ve got a few questions.

How expensive is college?

What’s included in the cost of college?

Where exactly does my child’s tuition go?

How can I pay for all of this?

Don’t worry–all these questions will soon be answered! After reading this article, you should have a better idea of the costs of college.

Costs of college

1. Tuition

You’ve probably heard the word “tuition” thrown around a lot, but what exactly is tuition?

Basically, tuition is what colleges insist you pay for the valuable material they’re teaching you.

But how is tuition charged? Well, it’s usually charged by the units or credit-hours that make up an academic year, such as a semester or quarter. (An academic year typically runs from fall through spring).

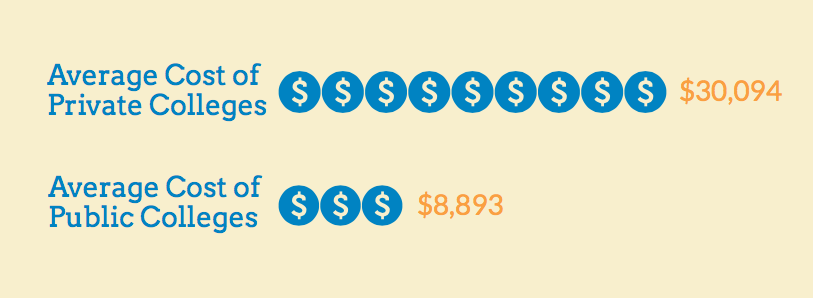

The actual dollar amount of tuition varies by college and by type of student.

Tuition at Ivy League Schools and other private schools range from $35,000-$45,000 for all students.

Public Universities are often much cheaper, ranging from $8,000-$10,000 for in-state applicants, and $20,000-$25,000 for out-of-state applicants.

Tuition at some colleges can also vary by major.

A spot of CollegeData: “Students in the sciences, engineering, computing, premed programs, and the fine arts often pay more.”

As an example, the folks at CollegeData noted that at University of Illinois Urbana-Champaign, the cost of tuition for students enrolled in the science and engineering programs was $4,920 higher for the 2013–2014 academic year.

Already have a major in mind, and you’re worried about the price tag suddenly jumping up? When tuition changes, it’s called “variable tuition”…and if your student has their heart set on one of the above majors, you might want to do some research on variable tuition.

2. Fees

Unlike tuition, fees are fixed dollar amounts, and are the same for both in-state and out-of-state students.

So, what exactly are these “fees” I’m talking about? Well, they basically constitute all the random stuff that tuition doesn’t pay for.

This “random stuff” includes:

- ID cards

- Student union membership

- Health insurance

- Gym membership

- Diplomas

- Caps and gowns

- Supplies for labs (beakers, photosensitive liquid, etc.)

- Internet fees

- Computer maintenance

- Orientation costs

- Administrative costs

- Etc…

Looking to know more about your student’s school’s specific fees? Go to the school website, and contact the registrar’s office, admissions office, or financial aid office.

3. Housing and Meals

Every university has a slightly different room and board setup. You’ve got different types of housing:

- Dorm-style

- Apartment-style

…and then different types of meal plans.

So, it makes sense that your cost of room and board is pretty dependent on the type of room and board that your student chooses!

According to CollegeData.com, “The College Board reports that the average cost of room and board in 2013–2014 was roughly $9,500 for public school students and $10,830 for private school students.”

Wow.

Well, what if you’re looking to forgo the dorm expenses? Can your student still get a meal plan?

The good news is that the answer is yes. Meal plans and housing plans tend to be available separately. This means that your student can stay at home with you, save a ton of money, and still eat on campus during the day.

4. Books

At just about any college your student is looking to attend, the fancy-dancy people in the financial office tend to know that, in school, supplies and books are usually part of the equation.

This means that they’ll figure out a little estimate of these costs, and usually publish it on their website.

Besides the obvious (textbooks), what other school materials might your student need?

- Printed class materials

- Extra required reading materials (classic novels for an English class)

- Reference books

- General office supplies (pens, pencils, file folders, notebooks, the occasional fun highlighter)

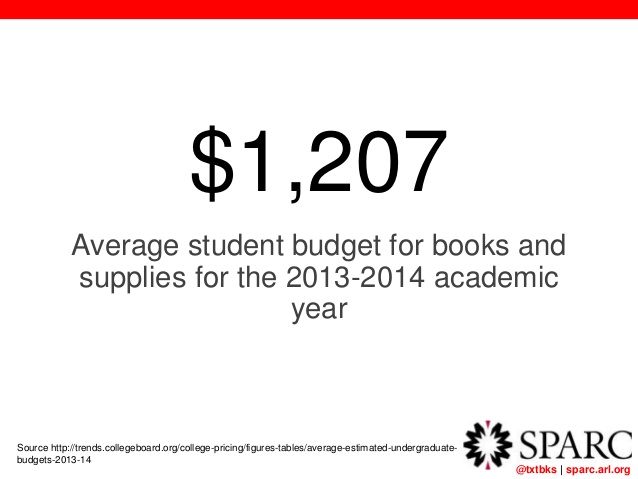

Some colleges include the cost of a computer and computer accessories. Some colleges don’t include these costs at all. The College Board reports the average cost for books and supplies for the 2013–2014 school year was $1,207 at public colleges and $1,253 at private colleges.

5. Personal Expenses

This one all depends YOUR STUDENT.

These sorts of expenses include local transportation, airfare (if they’re an out-of-state student), clothing, personal items, entertainment, etc.

Of course, colleges try and estimate these expenses, and use different titles for them. “Miscellaneous” is one. “Other” is another.

Another CollegeData tidbit: “The College Board reports that expenses in this category for 2013–2014 ran from $2,580 at private colleges to $3,228 at public universities.”

Wow. Make sure that’s something you keep in mind when you’re budgeting for your student’s college education!

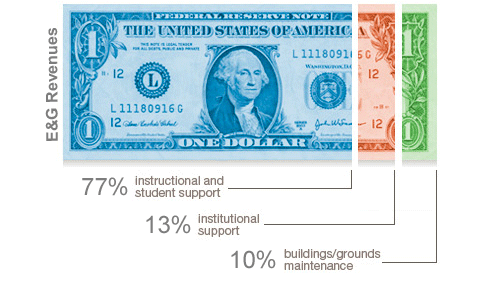

Where exactly does my student’s tuition go?

Obviously, the exact breakdown of your tuition’s uses is a little different for every school. But just as a basic example, here’s what tuition pays for if you’re a student at Virginia Commonwealth University.

But generally, here’s what you can count on. Tuition helps:

- Pay professors

- Fund research

- Fund student resources (libraries, counseling, campus tutors, etc.)

- Fund scholarships (so the money goes back to you!)

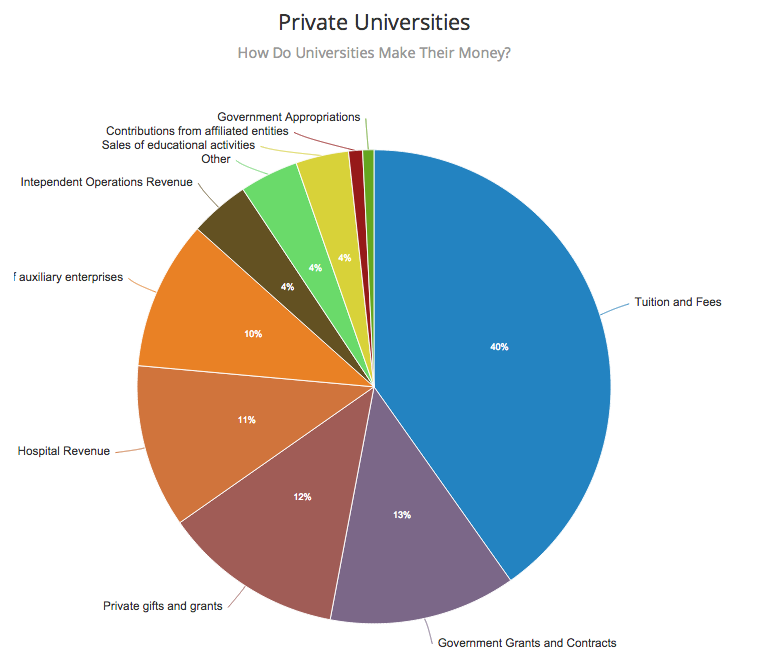

Click the pie chart below for Radio Open Source’s full, interactive breakdown of college costs!

How can I pay for all this?

Apply for financial aid.

Is your son or daughter an independent student? Do they come from a low-income background?

Depending on their family’s financial situation, they may qualify for financial aid. The U.S. Department of Education offers over $150 million dollars each year to help millions of students pay for higher education.

To find out if they qualify for financial aid, and to submit their Free Application for Federal Student Aid, go online to fafsa.ed.gov.

Even if they don’t qualify for federal grants, they may be eligible for federal student loans or work study, both of which can help tremendously in financing a college education.

Apply for merit-based scholarships

The name says it all–these are scholarships awarded on the basis of academic merit.

Perhaps the most well known of these types of scholarships is the National Merit Scholarship.

To qualify for the National Merit Scholarship your student’s PSAT scores must be among the highest in the country, and they must also submit a separate application detailing their coursework and extra curricular activities.

Most public universities also offer some sort of merit-based scholarship to in-state students. If your student plans on staying in-state for college, check out the scholarships their school offers–they may qualify for one!

Apply for local/private scholarships

These scholarships are a little more obscure and can be a bit more difficult to come by, but if they’re willing to do some digging it can be well worth the effort.

To find these sorts of scholarships, ask yourself the question, “what makes my child unique?”

- Are they an olympic gold medalist?

- Are they an award-winning violinist?

- Are they a first-generation college student of Mexican descent?

If you answered yes to any of those questions, odds are there’s a scholarship out there for your child. Even if you didn’t answer yes to any of those questions, I’m sure there’s a scholarship out there for which they qualify.

Conclusion

Yes, college can cost a pretty penny… But now you know where the money goes, and you know how to get started financing your student’s college adventure!

So, next time you find yourself confused about all this money business, remember:

- The college price tag is made up of tuition, fees, housing/meals, books, and personal expenses.

- Tuition helps pay the professors, fund research, scholarships, libraries, and more!

- There are many sources for financial aid, to help keep your wallet from stinging so much.

Which college is your high schooler dreaming of? What are your fondest college memories? Let us know in the comments below!

Todd VanDuzer

Latest posts by Todd VanDuzer (see all)

- Why Finding the Right Thing to Study Matters: Setting the Foundation for Success - July 26, 2023

- How USA Staff Onboarding Benefits From Innovative Software - July 26, 2023

- Top 7 Best Reasons to Get an MBA - June 7, 2023

- How to Support Your Child When They Go to College - April 29, 2023

- How to Maximize Your Job Search with Expert Resume Writers Experienced in Your Field - April 20, 2023